https://www.cnbctv18.com/energy/coronavirus-lockdown-refineries-to-run-at-lower-capacity-lpg-demand-sees-threefold-increase-5593021.htm

Petrol and diesel may be essential commodities, but demand for them has been hit because of the nationwide lockdown. This, even as refineries and gas marketers have been ensuring timely delivery of supplies. Given slackness in demand, refineries are in various stages of reducing output.

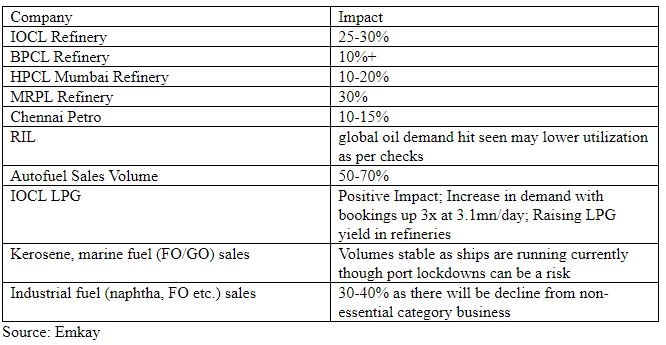

Oil Marketers

A recent filing by IOCL said it will be reducing crude throughput by 25-30 percent due to lower demand. HPCL and BPCL, according to reports, are also expected to do the same. HPCL’s CMD told CNBC TV18 that refinery throughput is expected to go down due to lower demand. t. While petrol pump dealers have indicated 70-80 percent hit to auto-fuel sales volumes, company checks suggest it to be around 50 percent . Further, industrial fuels such as naphtha, FO and bitumen have seen a 30-40 percent drop. Demand for fuels like kerosene, marine oil and LPG has been stable due to strong demand. LPG demand has gone up significantly which can be due to panic buying though there is no shortage. Overall marketing sales volumes are estimated to be down 30-40 percent during the lockdown. Port closures could affect marine fuel demand going ahead. IOCL has officially announced a 25-30 reduction in refinery throughput. HPCL’s indicative number is also up to 30 percent. BPCL indicated a 10 percent cut a few days ago, but it could go up significantly next week. MRPL has indicated that a decision on whether to close one crude distillation unit will be taken soon as demand is very weak.

Oil and Gas Producers

According to some industry experts, India’s crude oil production is set to register its biggest fall in two decades as several industries are in lockdown. Domestic volumes may remain steady but imports could drop.However, gas production will be hit. Emkay’s channel checks with ONGC indicate a 5-7mmscmd decline in gas sales volume due to lower demand although the company is trying to shut down some wells and reduce flow rate to offset weak impact. Oil India’s gas demand hit would also be 7-8 percent with reduced offtake from smaller industries such as tea gardens.

Gas companies

Checks suggest that GAIL may see a 15-20 mmscmd decline in marketing volumes as the lockdown progresses, while transmission volumes may also decline up to 10-15mmscmd. In addition, with the closure of distribution channels and truck transportation, GAIL’s petchem sales have stopped. Although the Pata plant is currently operating normally, the utilization is likely to go down going forward. GSPL’s throughput is down by ~5mmscmd, with City Gas Distribution being hit. Morbi Ceramic's offtake is seen falling by over 4mmscmd to under 3mmscmd currently, while CNG sales in Gujarat is down 80 percent. CNG sales in Delhi and Mumbai are also estimated to be down 70-80 percent as except for a reduced number of buses and essential service vehicles, other vehicles remain mostly off-road. IGL has closed 95 of its 150 company owned company operated outlets to rationalize volumes. Commercial PNG volumes are also significantly down as restaurants and hotels are closed, and the scenario is similar for industrial PNG demand from MSMEs. The Dahej terminal’s utilization is likely to be down by around 20 percent. It would be the same with other LNG terminals.

Comments